Real Estate keeps flying off the shelves like at a discount market with bonus points. You don't need to give away Green Stamps to sell in this real estate market. California, our area especially, has the most $1 million home sales in America. Even lowly Dead Wood City (Redwood City) has gone into the top with homes selling at $2000 per square foot. Does this end or do we still buy.

First of all, you are not buying Meta or any one of the other FAANG stocks. You are buying a home to live in.

I finished speaking a friend who I have known for over 40 + years and lives and works in Lake Tahoe. We spoke about housing prices and interest rates. He remembered when he bought his home in Zephyr Cove and paying 12.5% mortgage rate, and felt he had a deal. I recalled that we bought some few months before his purchase in Cow Hollow San Francisco and paid 14.5% for our mortgage. We too felt we had a deal and loved our 1904 Edwardian. So what's the difference between double digit interest rates and the last increase?

I recalled how a client called and told me he had his commitment letter cut 30%! The mortgage rate quoted for the commitment went to 4.75% from 2.75%. NOW WHAT? Well, you either come up with the difference in down payment to stay at the same home price or cut back and look elsewhere where you can comply to the loan commitment.....BUT..."that's a 30% increase in my down payment! I'm looking at a 50% down not 20% down." It is what it is! Rates are still a bargain. They will not decline! The FED has already said that on May 4th there will be a 1/2% increase and two more to follow. That means that today's mortgage market in the Sunday paper was 5.42% for a 30-year mortgage. That will take it to 6.92%, my approximate guess to a 30-year mortgage.

With inflation at 7-8% annually that still means mortgage rates will be under inflation and a great deal!

So buyers need to look at the economics and whether they wish to live an a specific area, or will another area make do?

My friend of over 40 years has told me how buying on Lake Tahoe and the communities surrounding it are in a construction boom! He just bought a 6000+SF home with 5+ bedrooms and baths on 2.5 acres for $2.4 million. A GREAT DEAL, COMPARED TO REDWOOD CITY 1350 SF HOMES AT $2.4 MILLION. Yeah he said. "They are your people. They are coming up to Tahoe and buying and working remotely. No taxes, bigger homes, cheaper homes and new construction. What a Deal!"

Now where does that leave us in our real estate market? Two types of real estate transactions. For those who have owned for sometime, retired, semi-retired or just ready to move there are numerous options, sell and look for fresher grounds. To those looking to get that home in Atherton and Woodside the options are just one BUY!

Stock options need to be re-priced, portfolio's are down. Hopefully there are large cash reserves. Cash is King in this market. All Cash buyers will win, always!

Even though the stock market is down, and in my opinion it is never too late to raise cash! Real Estate will always be the best asset to hold. It is your Real Estate!

Are there any bad omens out there? Certainly, interest rates are one. Fix and Flippers are another.

No matter how you look at it, there are people who have limited budgets and do not have have options and a large stock portfolio. They need to find a home with good schools for their children and still be in proximity to health and shopping and work, if necessary.

In my opinion, communities like Redwood City have been discovered. Redwood City has fairly good schools, great in some areas and not so great in others. Private schools in the City and some nearby. Shopping is near and the health care is excellent from Palo Alto Medical to Stanford, as examples. The neighborhoods are safe with neighbors who look after one another.

Fremont, El Dorado Hills, Granite Bay and Sacramento area have all been discovered and continue to grow in population and home prices.

I am still of the opinion that it is a buy in real estate no matter where you look. Interest rates lower than inflation put the benefits to the buyer and the borrower. Homes have been fixed up by the Fixer Flipper market, which takes the onus off the buyer for updating a new purchase. That in itself is worth the purchase.

Bad omen to the potential problems. Fix and Flippers have dominated the first time buyer market. That market is impacted by the rise in mortgage rates. That buyer may just ship east across the bay to find a less expensive and a more affordable home. If that begins to create a trend, which I take is happening now, it will put pressure on the Fix and Flipper as their loan is based upon completion and sale. That either occurs in a market sale by the investor/contractor or the bank takes on and sells at cost. That could lead to a softness in our market at least for an interim factor. Is it occurring? Well, so far I only know one one situation of an upscale property in the Sacramento area that a colleague was given an REO to sell. So far, the only indication locally has been my broker training agents in the terms and conditions of listing of bank owned real estate.

One thing I do know is, you will not see it in the local news until it is almost over. News needs adds and adds are realtors, banks and builders. They don't make money out of anything other than advertising!

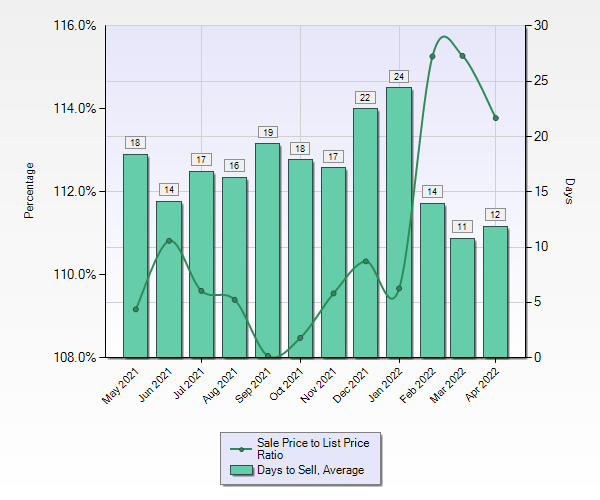

When I look at the daily new listings, sold, pending I am beginning to see more listings than pending and sold. There are starts in price cuts too. Nothing to tell me we are not out of the "sellers market". So feel safe, Buyers should buy now as those rates have two more 1/2% increases forthcoming. For sellers, I do not see any worry of severe price cuts. Just don't get greedy and too optimistic over what you THINK your house is worth. Let the market tell you.

The best place to look in this market for value is the VACANT LAND MARKET! Motely Fool had a recent article which I will add here....

KEY POINTS

The right plot of vacant land can hold nearly limitless potential.

A large plot of land comes with more options, but a smaller plot can be a great investment, too.

The current housing market is making land investing even more appealing.

When you think of real estate investing, you probably think primarily of various types of residential or commercial buildings. And it's true that from single-family homes and apartment buildings to retail, office space, and warehouses, most of the real estate investing we discuss here at The Motley Fool involves buildings of one type or another.

But with all its potential and possibilities, vacant land can be a very exciting investment. Let's take a look at a few options when investing in vacant land, as well as some pros, cons, and considerations.

Thinking big

If you can find a reasonably good deal on a large plot of land in the right area, it could be worth buying and holding on to. It's likely to appreciate in value over time as demand grows, and there are several ways you could make money off of it in the meantime.

Possibilities to explore, depending on the characteristics of the parcel and its location, include selling the mineral rights, setting the property up as a hunting lease, or even leasing it out as farmland. You could also think long term by planting a portion of the land in timber while still making an income through one of the aforementioned methods. (Carbon Credits a new income source in Redwoods)

From 2020 to 2021, the value of farmland, cropland, and pastureland in the U.S. increased around 7%. That's a huge increase for a one-year period.

Current developments in the housing market are also a huge plus for landowners. After a significant dip, homebuilding is back in a big way. New home construction is up 22% over this time last year, making the prospect of starting a housing development well worth looking into if you think you've found the right land for that type of project.

Thinking small

But what if you don't have hundreds of thousands of dollars to invest in a huge parcel of land? In that case, you may want to simply take it one lot at the time -- one residential lot, that is. If you can buy an undeveloped, or "raw," lot in a new or desirable residential area and make some improvements to the land, you may be able to sell it at a considerable profit to someone looking to build their dream home. Think of this as the land version of house flipping.

These improvements could include clearing a site on the land where a home could eventually be built and creating easy access to that area, if needed. This could be an effective way to take advantage of the homebuilding boom without having to make a huge up-front investment, perhaps especially in a growing suburb. And this way, you can take it one piece at a time.

Should you consider vacant land?

If you've been investing in real estate primarily in the form of homes or commercial property, vacant land can feel like an entirely different ball game. But the most important difference is that you'll need to ensure any land you're interested in will be suitable for your intended purpose (or purposes) before pulling the trigger. This could include making sure most of the land is high and dry and that it isn't subject to any zoning restrictions that could get in the way of your plans.

The vast potential of vacant land is a big part of its appeal. So is its simplicity, in that you don't have to do anything but hold it and wait for it to appreciate, if that's your preference. But the No. 1 reason vacant land is often a safe investment is a bit of a cliché, and for good reason: They simply aren't making it anymore.

GARY MCKAE VACANT LAND LISTINGS:

18.1 ACRES MIDDLETON TRACT LA HONDA APPROX 70% OLD GROWTH REDWOODS, $1.4 MILLION

3.1 ACRES MIDDLETON TRACT $449,000

3 ACRES MIDDLETON TRACT $349,000

Gary McKae