There is something missing from the "Media" that must be addressed in forecasting Home Prices. What you and I have either read or seen has dealt with Recession, Bear Market in Stocks and forecasts on the housing market. All forecasts are based upon history. History going back before anything a dramatic as what we have experienced in past 2 years.

Certainly as Lord Toynbee wrote "History Repeats Itself" there is truth. History is not alway repetitive in circumstance that eventually lead to a conclusion. Let us take the Federal Reserve System and the Board of Govenors action to lower interest rates and take on a strategy of using Quantitative Easing. A never in history event would not result in "History Repeating Itself". In fact it is more of creating a new history. The back page of the Friday, June24, 2922, Edition of the Wall Street Journal Business & Finance Section points out Americans usually lack something heading "A LOT OF CASH".

Consider that the FED unleashed $9 Trillion into the the US economy to stop an economic collapse from the Pandemic, and then to create inflation. The trouble with considering this large amount of money. (More money and assets on the FED Balance Sheet were created Historically!) It fed the pockets of everyone from Wall Street to the average American.

At the end of the first quarter 2022, U.S. Households held $17.9 trillion in cash and cash equivalents. This was up from $13.7 trillion they held at the end of the first quarter 2020.

Now comes the most interesting statistic. People in the top 10% held 32% more in cash and cash equivalents, BUT people in the bottom half HELD 45% MORE! It rose for whites, black, hispanics. It rose for college graduates and high school graduates. It rose for Millennials, Gen-Xers and Boomers! In addition; the equity in home values increased at multiple factors, portfolios increased. The economic wealth of U.S. Households are or have never been better going into a fear of a Recession.

Jobs are still in demand. Virtual jobs out distant demand in work in location jobs. The ability of households to find lower cost of living communities allow workers to work were affordable. Those areas tend to be smaller, safer and have as good as or better schools.

The cost of living by inflationary costs do affect the portion of take home pay that is not spent...SAVINGS. that portion fell to 4.4% in April. In pre-pandemic era it was 7.6%. Even with inflation it will take until the end of 2023 per Barclays Economists to drain off excess cash. Even so, there is an offset of higher interest rates increases to balances.

This does not mean consumers will spend willy-nilly. They have learned just as the Baby Boomers Parent learned from the Depression Era Parents.....They Saved!

Consumer appetites, in my opinion, have most likely been sated. All the durable goods have been bought. Cars will last to at least 200,000 miles.

The type of Belt Tightening that has happened in past Recessions may never happen! That will blunt any Recession or any depth to the economic downturn.

Then we have "Guns or Butter" in economic spending. Thank you President Putin. Guns built and expended need to be replaced. Oil is needed, drilling must increase. Nuclear plants need to be built that are far better than any ever produced. Think this, there is only one producer here in the U.S: GE and Westinghouse, a privately owned company. Plants are now smaller and more efficient, thanks to Bill Gates Foundation. Companies are moving back to the U.S. Finally, as noted prior; Butter are Consumer Durables and they have been purchased

The positive outweigh the negatives. Housing Prices could see some hesitancy to follow higher. Buyers could find areas outside the Bay Area that fit their budgets and life style. Companies could build in less expensive areas and draw employees away from the Bay Area.

Through natural selection home prices for the Bay Area could see reality and more listings will compete for sales, price cuts will become a standard, agents will offer incentives. Homes not sold will come on the Rental Market and rents will decline. All sound good for buyers and renters.

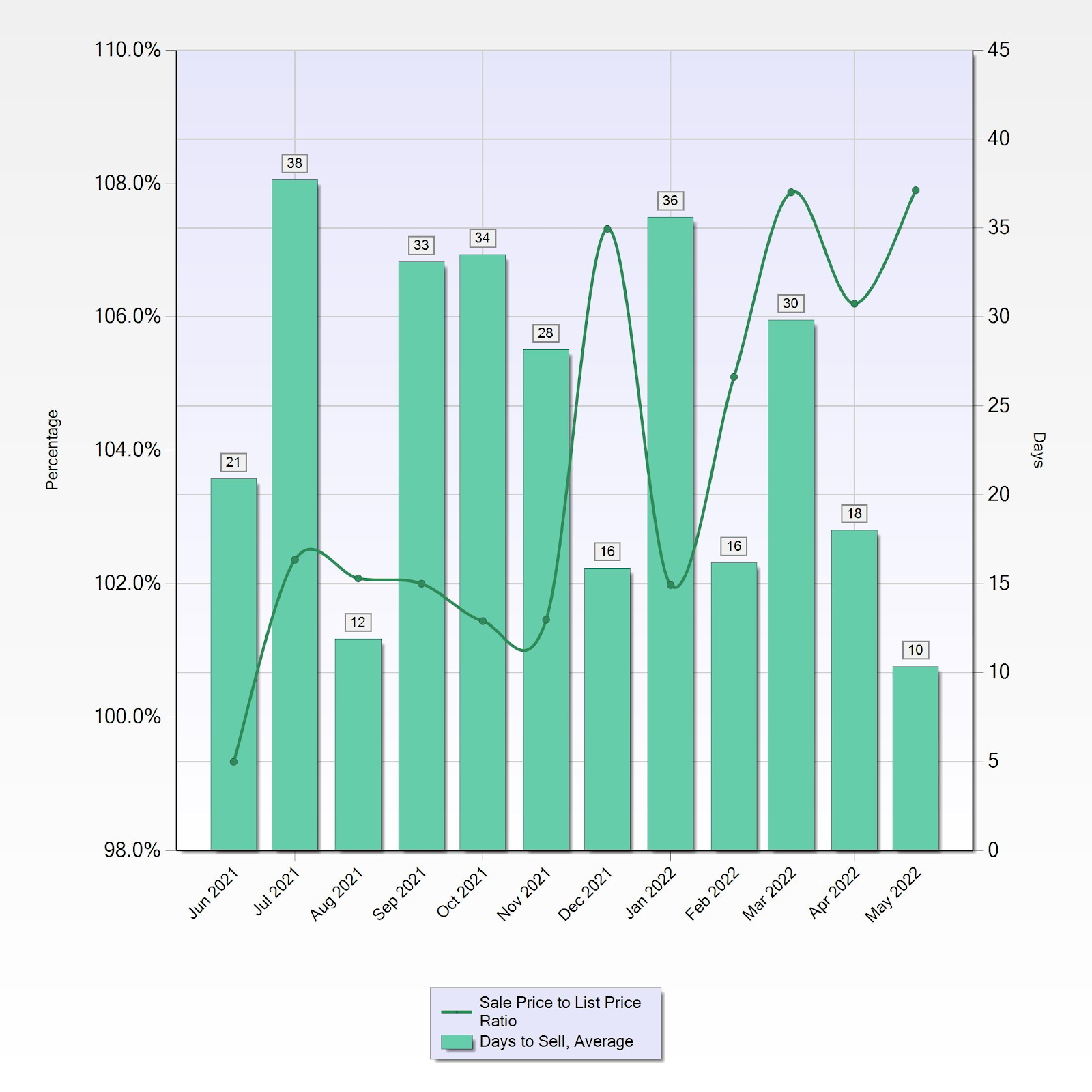

Just looking at the MLS Listing Summary for the past 7 days there has been increases in homes listed, prices cut. Compare the current Summary to last weeks Summary and make your own opinion..,